Get Real-Time Advice and Analysis on a Dedicated Forex Trading Forum

Get Real-Time Advice and Analysis on a Dedicated Forex Trading Forum

Blog Article

Checking Out the Effect of Currency Exchange Fees on Your Investments

The influence of money exchange rates on investments is a nuanced topic that necessitates careful consideration, especially for those participating in worldwide markets. Changes in currency exchange rate can all of a sudden change the value of foreign financial investments, affecting general portfolio efficiency. As financiers navigate these intricacies, recognizing the interplay between money dynamics and asset worths ends up being important. This discussion will certainly highlight necessary methods for mitigating currency threat, yet it likewise raises relevant inquiries regarding how to properly position one's profile in a progressively interconnected global economic situation. What ramifications might these understandings hold for your investment strategy?

Recognizing Currency Exchange Rates

The details of currency exchange rates play a crucial role in the worldwide economic landscape, influencing financial investment choices across borders. Money exchange prices represent the value of one money in regard to one more and are figured out by various elements, consisting of rate of interest, inflation, political stability, and financial efficiency. Recognizing these rates is important for capitalists participated in international markets, as variations can considerably impact the earnings of financial investments.

At its core, a money exchange rate can be categorized as either dealt with or drifting. Dealt with exchange rates are fixed to a steady currency or a basket of currencies, supplying predictability yet limiting versatility. Conversely, drifting currency exchange rate fluctuate based upon market forces, enabling even more responsive changes to economic facts.

In addition, exchange rate activities can be influenced by speculative trading, in which capitalists acquire or offer money in expectancy of future modifications. Understanding of these dynamics allows investors to make educated decisions, reduce risks, and maximize opportunities in the fx market. Eventually, an extensive understanding of money exchange rates is important for browsing the complexities of global financial investments efficiently.

Impacts on International Investments

Changes in money exchange rates can significantly influence international investments, affecting both the returns and dangers related to cross-border transactions. When a financier allocates funding to foreign markets, the worth of the financial investment can be impacted by shifts in the money set in between the capitalist's home currency and the international money. If the foreign currency diminishes versus the investor's home currency, the returns on the investment may reduce, also if the underlying possession performs well.

Additionally, money threat is an intrinsic consider global financial investments, necessitating a cautious evaluation of possible volatility. This threat can result in unforeseen losses or gains, making complex the financial investment decision-making process. Investors might alleviate this danger via various strategies, such as money hedging or diversity throughout multiple currencies.

Additionally, currency exchange rate changes can additionally influence the good looks of international financial investments family member to domestic choices - forex trading forum. A strong home currency may motivate residential investors to seek chances abroad, while a weak home currency might hinder financial investment in international possessions due to perceived greater costs. Eventually, recognizing these effects is vital for financiers intending to enhance their international portfolios while managing currency-related threats efficiently

Effect On Buying Power

Adjustments in money exchange prices can directly deteriorate or improve buying power, affecting consumers and financiers alike. When a money strengthens versus others, it increases the buying power of consumers holding that currency, permitting them to acquire more products and solutions for the exact same amount of cash. On the other hand, a weakening currency diminishes acquiring power, making foreign products a lot more pricey and potentially causing inflationary pressures domestically.

For financiers, the ramifications of altering currencies expand beyond instant purchasing power. Investments in international markets can yield various returns when transformed back to the financier's home currency. A solid home money can raise the value of foreign investments upon repatriation, while a weak home money can lower returns significantly.

Moreover, changes in currency exchange rate can influence customer behavior and spending patterns. A decrease imp source in buying power might cause consumers to prioritize crucial items over luxury products, consequently impacting the more comprehensive financial landscape. Understanding the effect of currency exchange prices on acquiring power is critical for making informed monetary decisions, whether one is a consumer browsing daily costs or a capitalist assessing the practicality of international chances.

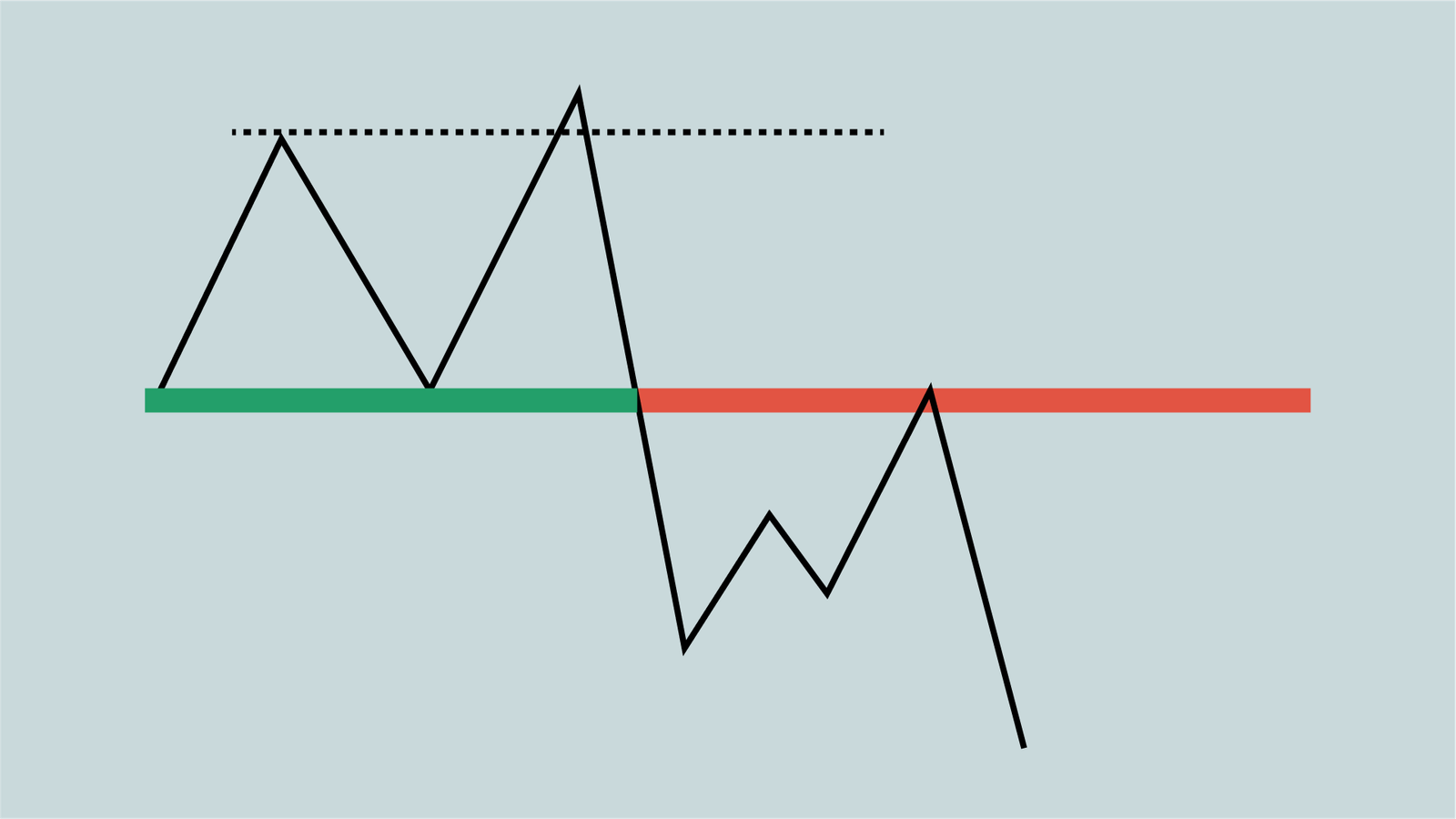

Strategies for Money Danger Management

One more technique is diversity, which entails spreading out financial investments throughout various currencies and geographic areas. This decreases exposure to any type of solitary money's volatility, consequently supporting general returns. Capitalists may likewise think about buying currency-hedged funds, which are specifically designed to reduce currency danger while still offering access to foreign markets.

Furthermore, keeping a close watch on financial indications and geopolitical occasions can aid capitalists make notified decisions concerning their money exposures. Applying a disciplined method to money threat management via routine analyses and adjustments can further boost strength versus undesirable exchange price activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-01-a6be7f7fd3124918a519946fead796b8.jpg)

Instance Research Studies and Real-World Instances

How do real-world scenarios highlight the intricacies of money exchange rates on investment end results? Think about the case of a U. forex trading forum.S.-based financier who acquired shares in a European modern technology firm. Originally, the investment appeared appealing, with the supply cost rising gradually. A sudden appreciation of the euro against the dollar resulted in lessened returns when the capitalist chose to liquidate their placement. The gains made in the securities market were balanced out by unfavorable currency exchange rate activities, showing how money changes can substantially influence investment success.

One more illustrative example involves an international firm earning revenue in various money. An U.S. company with significant operations in Japan saw its revenues eroded when the yen weakened versus the buck. This currency depreciation led to a reduction in reported revenues, prompting the firm to reassess its international earnings approach.

These study underscore the necessity for financiers to monitor money exchange patterns proactively. They highlight that while direct investment efficiency is crucial, the interaction why not try these out of exchange rates can dramatically modify overall investment end results, necessitating a detailed strategy to run the risk of monitoring.

Verdict

In final thought, money great post to read exchange rates play an essential duty in forming investment end results, especially in global markets. An extensive understanding of these characteristics, paired with effective risk management strategies such as hedging and diversification, is important for financiers looking for to optimize returns and minimize possible dangers linked with currency activities.

Report this page